The recent update on Adani Green Energy’s share

- Adani Green Energy reported a significant performance in the Q3 financial result. The company’s net profit increased by 148% and reached Rs 256 crore.

- The company’s shares rose by 5.1% on Monday, reaching an intraday high of Rs. 1750. However, on Tuesday, it declined by -2.10% and closed at Rs1679.45.

- The total earnings for the period increased to Rs. 2,675 crore, up from Rs. 2,256 crore in the previous quarter.

- Adani Geern Energy’s CEO, Amit Singh, emphasized the strategic importance of debt and equity capital infusions and established an asset management plan to secure a growth path towards achieving a 45 GW capacity by 2030.

- The company’s operational capacity witnessed a notable annual increase of 16%, reaching 8,478 MW.

- The company’s electricity sales grew by 59% between April and December 2023, totaling 16,29.3 units.

- The company’s market cap currently stands at ₹2,67,440 crore, reflecting the volatility and resilience of the renewable energy sector.

- The company’s fundamental analysis presents a market capitalization of ₹2,67,440 crore, a current share price of ₹1,688.70, and a book value of ₹50.1.

- The company has outlined ambitious share price targets for the years 2024–2030, with subsequent targets increasing in the following years.

- The shareholding pattern shows a gradual decline from 60.75% in December 2022 to 56.37% in December 2023.

- The company’s profit growth over the last ten years stands at an impressive 160% in the current fiscal year.

About Adani Green Energy Limited

- Adani Green Energy Limited, a holding company within the Adani Group, is a leading player in India’s renewable energy sector.

- The company is committed to improving lives, generating value, and empowering communities.

- Adani Green Energy Limited’s mission is to contribute to a cleaner, greener future for India through renewable power generation.

- The company’s core business involves developing, building, owning, operating, and maintaining utility-scale grid-connected solar and wind farm projects.

- Adani Green Energy Limited has secured long-term power purchase agreements (PPAs) with central and state government entities for a stable revenue stream and to mitigate power price fluctuations.

- The company uses cutting-edge technologies in its projects to ensure efficiency and sustainability.

- Adani Green Energy Limited has a diverse portfolio, with 54 operational projects and 12 currently under construction.

- The company is poised for continued growth with a robust project pipeline, ongoing technological advancements, and a strategic focus on long-term PPAs.

Management of Adani Green Energy Limited

| Gautam S Adani | Chairman |

| Sagar R Adani | Executive Director |

| Dinesh Hasmukhrai Kanabar | Independent Director |

| Romesh Sobti | Independent Director |

| Vneet S Jaain | Managing Director & CEO |

| Rajesh S Adani | Director |

| Raminder Singh Gujral | Independent Director |

| Ahlem Friga-Noy | Nominee Director |

Registered Address

Adani Corporate House,

Shantigram, Nr. Vaishno Devi Circle, S G Highway, Khodiyar,

Ahmedabad

Gujarat

382421

Tel: 079-25555555 079-26565555

Fax: 079-25557177

Email: investor.agel@adani.com

Website: http://www.adanigreenenergy.com

Industry Type

Sector: Power

Sub Sector: Power Generation

Classification: Largecap

Industry Name: Power Generation and Supply

BSE Scrip Code: 541450

NSE Scrip code: ADANIGREEN

ISIN: INE364U01010

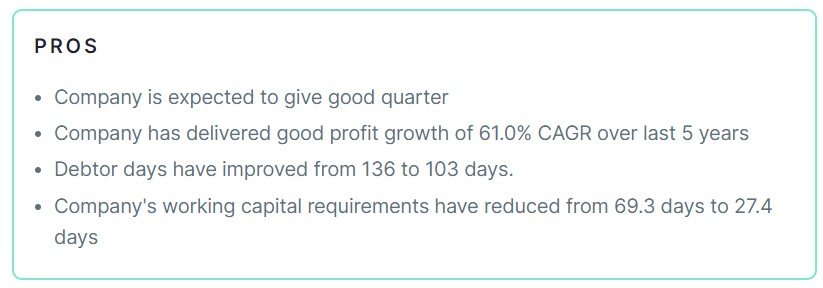

Pros & Cons of Adani Green Energy Limited

Historical Performance

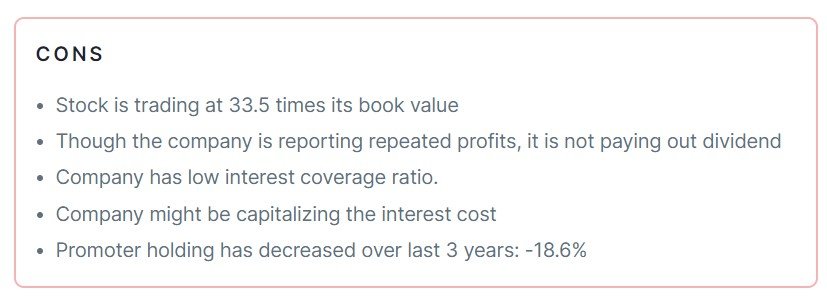

| Years | Low | High |

| 1 Year | 439.10 | 1762.05 |

| 3 Years | 439.10 | 3050.00 |

| 5 Years | 30.15 | 3050.00 |

Investment Returns

| Period | Returns |

| 1 year | 41.25% |

| 2 Years | -10.57% |

| 3 Years | 63.97% |

| 4 Years | 830.70% |

| 5 Years | 4402.55% |

Chart

Also Read – Infibeam Avenues Share Price Rockets on Heels of ₹2000 Crore AI Deal with Government!

Fundamental Analysis of Adani Green Energy Limited

| Parameter | Value |

| Market Cap | ₹ 2,65,922 Cr. |

| Current Price | ₹ 1,679 |

| High / Low | ₹ 1,762 / 439 |

| Stock P/E | 162 |

| Book Value | ₹ 50.1 |

| Dividend Yield | 0.00 % |

| ROCE | 7.81 % |

| ROE | 22.8 % |

| Face Value | ₹ 10.0 |

| Pledged Percentage | 1.67 % |

| EVEBITDA | 35.3 |

| Change in Prom Hold | 0.11 % |

| Debt to Equity | 7.23 |

| Return on Equity | 22.8 % |

| EPS | ₹ 9.20 |

| Price to Book Value | 33.5 |

| Dividend Yield | 0.00 % |

| Debt | ₹ 57,378 Cr. |

Peer Comparison

Shareholding of Adani Green Energy Limited

Last 5 Years’ Sales (In Cr.)

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| 2,058 | 2,549 | 3,124 | 5,133 | 7,792 |

Last 5 Years’ Net Profit (In Cr.)

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| -475 | -68 | 182 | 489 | 973 |

Balance Sheet of Adani Green Energy Limited

Compounded Sales Growth

| 10 Years: | % |

| 5 Years: | 39% |

| 3 Years: | 45% |

| TTM: | 40% |

Compounded Profit Growth

| 10 Years: | % |

| 5 Years: | 61% |

| 3 Years: | 192% |

| TTM: | 160% |

CAGR

| 10 Years: | % |

| 5 Years: | 116% |

| 3 Years: | 19% |

| 1 Year: | 41% |

Return on Equity

| 10 Years: | % |

| 5 Years: | 10% |

| 3 Years: | 19% |

| Last Year: | 23% |

Cash Flow (In Cr.)

| Particulars | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 |

| Operating Activities | 1,625 | 1,965 | 1,601 | 3,127 | 7,265 |

| Investing Activities | -2,666 | -3,743 | -9,137 | -18,730 | -3,857 |

| Financing Activities | 1,045 | 2,161 | 7,083 | 15,986 | -2,973 |

| Net Cash Flow | 3 | 383 | -453 | 383 | 435 |

Revenue and Profit Trend

| Financial Year | Revenue Growth | Profit Growth |

| FY 2022-23 | -28.51% | 465.52% |

| FY 2021-22 | 331.54% | -115.93% |

| FY 2020-21 | 98.32% | 171.64% |

| FY 2019-20 | 291.98% | -483.03% |

| FY 2018-19 | -81.49% | -24.3% |

Also Read – ONGC Share Price Insight: FII’s Bold Play in Government Shares – A Year-Long Investment Guide.

Conclusion

This is a comprehensive guide to Adani Green Energy Limited’s share. The above-mentioned information and data are as of January 30, 2024. These figures and projections are based on our research, analysis, company fundamentals and history, experiences, and numerous technical analyses. In addition, we have discussed in depth the share’s prospects and growth potential. Hopefully, these details will be useful in your future investments. If you’re new to our website and want to stay up-to-date on the newest stock market news, join our Telegram group. If you have any further questions, please leave them in the comments section below. We will gladly address all of your inquiries. If you enjoyed this information, please share it with as many people as possible.

Disclaimer: Dear Readers, we are not authorized by SEBI (Securities and Exchange Board of India). The information provided above is for educational purposes and should not be considered financial advice or stock recommendations. Share price predictions are for reference purposes and are based on positive market indicators. The analysis does not account for uncertainties about future or current market conditions. The author, brokerage firm, or Finreturns.com are not liable for losses resulting from decisions. Finreturns.com advises consulting with certified experts before investment decisions.

[…] Also Read –Adani Green Energy Shines in Q3 with a 148% Surge in Net Profit – Targets 45 GW Capacity by 2030. […]

[…] Also Read – Adani Green Energy Shines in Q3 with a 148% Surge in Net Profit – Targets 45 GW Capacity by 2030. […]