Dolphin Offshore Enterprises (India) Ltd. has announced a stock split following the stock market closure. The company’s Board of Directors assembled for a meeting on January 12, 2024, to discuss the division of shares. The decision involves splitting shares with a face value of Rs 10 into 10 components, with the designated “record date” set for Thursday, January 25, 2024. As of the market closing, the company’s shares were priced at Rs 1559.40. Over the past six months, investors in Dolphin Offshore Enterprises have experienced an impressive return of 1265.27%, indicating the company’s positive trajectory in the market.

A stock split is a corporate action where a company divides its existing shares into multiple shares. In Dolphin Offshore Enterprises’ case, the decision to split shares aims to make shares more accessible to a broader range of investors. The company’s recent market performance has been robust, with a closing price of Rs 1559.40 and a remarkable return of 1265.27% over the last six months. The record date for the stock split is Thursday, January 25, 2024, determining which shareholders are eligible to receive the newly divided shares.

About Dolphin Offshore Enterprises (India) Ltd.

- Dolphin Offshore Enterprises Ltd. was incorporated in 1979. Dolphin Offshore Enterprises Ltd. provides underwater services to the offshore oil and gas industry.

- The services provided by the company include underwater diving and engineering, design and engineering, vessel operations and management, marine logistics, ship repair and rig repair services, fabrication, electrical and instrumentation services, offshore hook-up and commissioning, and undertaking turnkey EPC contracts.

- Its clientele includes Ban Lloyd, Bechtel International Inc., Cairn Energy, Engineers India, Fugro Geonics, Global Offshore, HPCL, IOCL, L&T, Mazgaon Docks, etc.

- In March 2023, the company approved the sale of 74.40 lakh shares of Dolphin Offshore Shipping Limited and sold its investments in Global Dolphin Drilling Company Limited and IMPaC Oil and Gas Engineering (India) Private Limited.

- In July 2020, the company was acknowledged to Corporate Insolvency Resolution process due to a default in payment of bank borrowings and outstanding debts to its operational creditors.

- The company was acquired by Deep Onshore Services Private Limited and commenced operations in January 2023.

- On November 4, 2019, the business was suspended from trading on the BSE and NSE due to suspension and penalties.

- On September 15, 2023, the company approved raising funds for the issuance of 8.42 lacs of securities.

- The company was unable to generate any revenue in FY23.

Management of Dolphin Offshore Enterprises Ltd.

Registered Address of Dolphin Offshore Enterprises Ltd

Unit No. 301, Zillion, Junction of LBS M

CST Road, Kurla (W),,

Mumbai, Maharashtra

400070

Tel: 022-22832226 022-22832234

Fax: 022-22875403

Email: info@dolphinoffshore.com

Website: http://www.dolphinoffshore.com

Industry Type

Sector – Oil, Gas &Consumable Fuels

Sub Sector -Offshore Support Solution Drilling

Classification – Smallcap

Industry Name – Oil Drilling/ Allied Services

BSE Scrip Code – 522261

NSE Scrip code – DOLPHIN

ISIN –INE920A01029

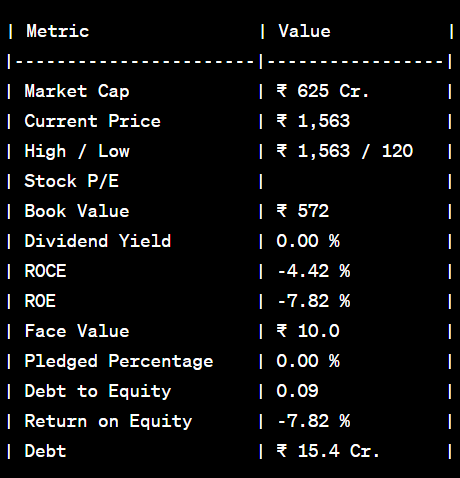

Pros & Cons of Dolphin Offshore Enterprises (India) Ltd.

PROS

-

- Company has reduced debt.

- Company is almost debt free.

CONS

-

- Stock is trading at 2.73 times its book value

- Company has low interest coverage ratio.

- Earnings include an other income of Rs.49.1 Cr.

Historical Performance

| Years | Low | High |

| 1 Year | 109 | 1562.55 |

| 3 Years | 109 | 1562.55 |

| 5 Years | 109 | 1562.55 |

Investment Returns

| Period | Returns |

| 1 year | 1265.27% |

| 2 Years | 1265.27% |

| 3 Years | 1265.27% |

| 4 Years | 1265.27% |

| 5 Years | 1265.27% |

Technical Analysis of Dolphin Offshore Enterprises (India) Ltd.

Chart

Moving Averages

| Period | Value | Signal |

| 5-EMA | 1502.52 | Bullish |

| 10-EMA | 1431.73 | Bullish |

| 20-EMA | 1303.23 | Bullish |

| 50-EMA | 1002.28 | Bullish |

| 100-EMA | 671.93 | Bullish |

| 200-EMA | 0.00 | Bullish |

Technical Indicators

| Indicator | Value | Action |

| RSI (14) | 100.00 | Overbought |

| ATR (14) | 24.43 | Range |

| STOCH (9,6) | 100.00 | Overbought |

| STOCHRSI (14) | 0.00 | Oversold |

| MACD (12,26) | 155.55 | Bullish |

| ADX (14) | 100.00 | Trend |

Fundamental Analysis Dolphin Offshore Enterprises (India) Ltd.

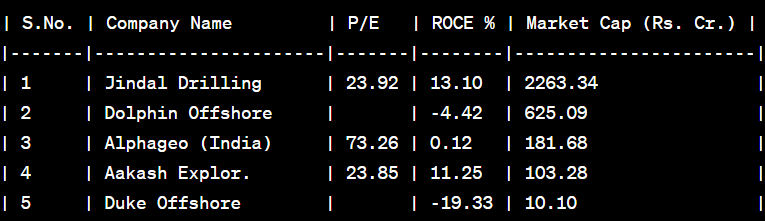

Peer Comparison

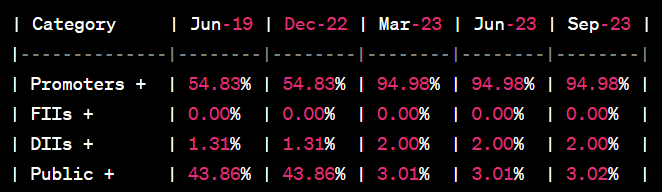

Shareholding Pattern

Last 5 Years’ Sales (In Cr.)

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| – | – | – | 0 | 3 |

Last 5 Years’ Net Profit (In Cr.)

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| – | – | – | -14 | 43 |

Last 5 Years’ Borrowings

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| – | – | – | 131 | 18 |

Compounded Sales Growth

| 10 Years: | % |

| 5 Years: | % |

| 3 Years: | % |

| TTM: | % |

Compounded Profit Growth

| 10 Years: | % |

| 5 Years: | 0% |

| 3 Years: | % |

| TTM: | 40% |

CAGR

| 10 Years: | 34% |

| 5 Years: | 95% |

| 3 Years: | % |

| 1 Year: | % |

Return on Equity

| 10 Years: | % |

| 5 Years: | % |

| 3 Years: | % |

| Last Year: | -8% |

Revenue and Profit Trend

| Financial Year | Revenue Growth | Profit Growth |

| FY 2022-23 | 0.00% | -1833.9% |

| FY 2021-22 | -100.0% | -85.78% |

Also Read – Smart Investment Choice: TATA Share Gains Buy Recommendation, Aiming for Sectoral Leadership.

Conclusion

This is a comprehensive guide to Dolphin Offshore Enterprises (India) Ltd. The above-mentioned data is as of January 13, 2024. These figures and projections are based on our research, analysis, company fundamentals and history, experiences, and numerous technical analyses. In addition, we have discussed in depth the share’s prospects and growth potential. Hopefully, these details will be useful in your future investments. If you’re new to our website and want to stay up-to-date on the newest stock market news, join our Telegram group. If you have any further questions, please leave them in the comments section below. We will gladly address all of your inquiries. If you enjoyed this information, please share it with as many people as possible.

Disclaimer: Dear Readers,

- We are not authorized by SEBI (Securities and Exchange Board of India).

- The information provided above is for educational purposes and should not be considered financial advice or stock recommendations.

- Share price predictions are for reference purposes and are based on positive market indicators.

- The analysis does not account for uncertainties about future or current market conditions.

- The author, brokerage firm, or Finreturns.com are not liable for losses resulting from decisions.

- Finreturns.com advises consulting with certified experts before investment decisions.