The recent update on Engineers India Ltd (EIL) share price

- Engineers India Ltd (EIL) is a mid-cap Navratna public-sector undertaking. The company is set to hold a Board of Directors meeting on February 2, 2024.

- The meeting will focus on the consideration and approval of the unaudited standalone and consolidated financial results for the third quarter and nine months ending on December 31, 2023, and discussions on an interim dividend for the fiscal year 2023–24.

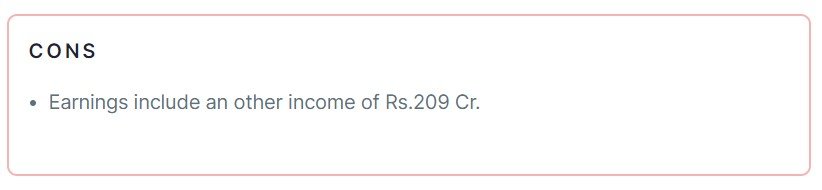

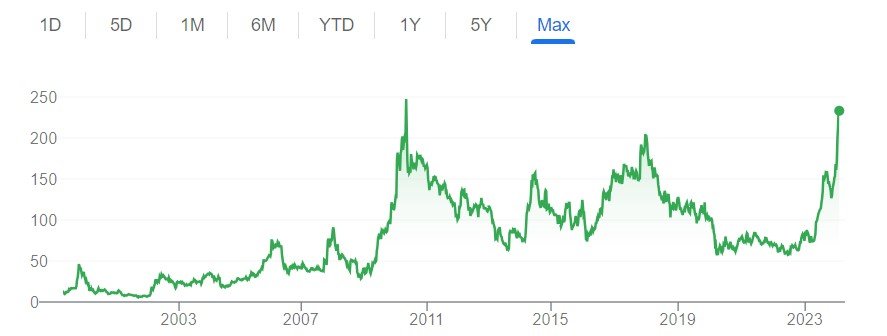

- The shares have seen a significant surge of 173% in the last year, contributing to the company’s current market capitalization of Rs 13,078.73 crore.

- The company has set February 12, 2024, as the “record date” for determining shareholder eligibility for any interim dividend.

- The company’s financial performance has been robust, with a significant improvement in net profit for the quarter ended September 30, 2024, and significant revenue growth.

- The Life Insurance Corporation of India (LIC) has cut its stake in Engineers India, selling 1.14 crore shares at an average price of Rs 118.08 apiece.

The history of Engineers India Ltd (EIL)’s Dividend

| Announcement Date |

Ex-Date |

Dividend Type |

Dividend (%) |

Dividend (Rs) |

| 24-01-2024 |

12-02-2024 |

Interim |

0 |

0.00 |

| 26-05-2023 |

25-08-2023 |

Final |

20 |

1.00 |

| 17-01-2023 |

13-02-2023 |

Interim |

40 |

2.00 |

| 27-05-2022 |

02-09-2022 |

Final |

20 |

1.00 |

| 25-01-2022 |

16-02-2022 |

Interim |

40 |

2.00 |

| 08-06-2021 |

06-09-2021 |

Final |

12 |

0.60 |

| 04-03-2021 |

18-03-2021 |

Interim |

28 |

1.40 |

| 25-06-2020 |

11-09-2020 |

Final |

31 |

1.55 |

| 05-02-2020 |

14-02-2020 |

Interim |

72 |

3.60 |

| 17-05-2019 |

18-09-2019 |

Final |

15 |

0.75 |

| 25-01-2019 |

15-02-2019 |

Interim |

65 |

3.25 |

| 25-05-2018 |

11-09-2018 |

Final |

30 |

1.50 |

| 01-03-2018 |

19-03-2018 |

Interim |

50 |

2.50 |

| 23-05-2017 |

11-09-2017 |

Final |

10 |

0.50 |

| 09-03-2017 |

23-03-2017 |

Interim |

50 |

2.50 |

| 26-05-2016 |

07-09-2016 |

Final |

40 |

2.00 |

| 18-02-2016 |

08-03-2016 |

Interim |

40 |

2.00 |

| 27-05-2015 |

14-08-2015 |

Final |

40 |

2.00 |

| 09-03-2015 |

23-03-2015 |

Interim |

60 |

3.00 |

| 23-05-2014 |

13-08-2014 |

Final |

60 |

3.00 |

| 10-03-2014 |

20-03-2014 |

Interim |

70 |

3.50 |

| 28-05-2013 |

12-08-2013 |

Final |

60 |

3.00 |

| 06-03-2013 |

18-03-2013 |

Interim |

60 |

3.00 |

| 28-05-2012 |

21-08-2012 |

Final |

80 |

4.00 |

| 01-02-2012 |

15-02-2012 |

Interim |

40 |

2.00 |

| 26-05-2011 |

26-08-2011 |

Final |

80 |

4.00 |

| 09-03-2011 |

22-03-2011 |

Interim |

20 |

1.00 |

| 28-01-2010 |

26-03-2010 |

Interim |

1000 |

100.00 |

| 26-11-2009 |

21-12-2009 |

Interim |

60 |

6.00 |

| 12-06-2009 |

09-09-2009 |

Final |

140 |

14.00 |

| 11-12-2008 |

29-12-2008 |

Interim |

45 |

4.50 |

| 03-06-2008 |

10-09-2008 |

Final |

70 |

7.00 |

| 06-12-2007 |

26-12-2007 |

Interim |

40 |

4.00 |

| 31-05-2007 |

05-09-2007 |

Final |

60 |

6.00 |

| 16-01-2007 |

05-02-2007 |

Interim |

35 |

3.50 |

| 29-05-2006 |

01-09-2006 |

Final |

50 |

5.00 |

| 12-01-2006 |

01-02-2006 |

Interim |

30 |

3.00 |

| 17-06-2005 |

02-09-2005 |

Final |

75 |

7.50 |

| 17-06-2004 |

02-09-2004 |

Final |

65 |

6.50 |

| 11-07-2003 |

12-09-2003 |

Final |

40 |

4.00 |

| 30-07-2002 |

11-09-2002 |

Final |

27.5 |

0.00 |

| 29-06-2001 |

30-08-2001 |

Final |

67 |

0.00 |

About Engineers India Ltd. (EIL)

- Engineers India Ltd. (EIL) was established in 1965. The company is a global leader in engineering consulting and EPC services.

- The company’s portfolio includes infrastructure, water and waste management, solar and nuclear power, and fertilizers.

- EIL offers ‘Total Solutions’ engineering consultancy services, covering the entire project lifecycle.

- The company has certifications for Quality Management System (QMS), Occupational Health and Safety Management System (OHSMS), and Environmental Management System (EMS) under ISO 9001, ISO 45001, and ISO 14001.

- EIL offers specialized expertise in areas like heat and mass transfer equipment design, environmental engineering, specialist materials, maintenance, plant operations, and safety services.

- EIL operates from various locations in India, including Gurugram, Mumbai, Kolkata, Chennai, and Vadodara.

- The company has a workforce of over 2400 engineers and professionals, with over 2800 individuals as of March 31, 2021.

- EIL extends its influence through subsidiaries and joint ventures, including Certification Engineers International Limited (CEIL) and Ramagundam Fertilizers and Chemicals Limited (RFCL).

Management of Engineers India Ltd (EIL)

| Name |

Designation |

| Vartika Shukla |

Chairman & Managing Director |

| A K Kalra |

Director – Human Resources |

| Rajiv Agarwal |

Director – Technical |

| Rohit Mathur |

Non Exec. & Nominee Director |

| Jai Prakash Tomar |

Non Official Independent Director |

| Harishkumar Madhusudan Joshi |

Non Official Independent Director |

| Karuna Gopal |

Non Official Independent Director |

| Sanjay Jindal |

Director – Finance |

| Atul Gupta |

Director – Commercial |

| Rajeev Gupta |

Director – Projects |

| Deepak Mhaskey |

Non Official Independent Director |

| Ravi Shanker Prasad Singh |

Non Official Independent Director |

| Prashant Vasantrao Patil |

Non Official Independent Director |

Registered Address

Engineers India House,

1, Bhikaji Cama Place,,

New Delhi

Delhi

110066

Tel: 011-26762121

Fax: 011-26178210 011-26194715

Email: eil.mktg@eil.co.in

Website: http://www.engineersindia.com

Industry Type

Sector: Construction

Sub Sector: Civil Construction

Classification: Small Cap

Industry Name: Engineering – Turnkey services

BSE Scrip Code: 532178

NSE Scrip code: ENGINERSIN

ISIN: INE510A01028

Pros & Cons of Engineers India Ltd (EIL)

Historical Performance

| Years |

Low |

High |

| 1 Year |

70.05 |

256.20 |

| 3 Years |

56.00 |

256.20 |

| 5 Years |

49.20 |

256.20 |

Investment Returns

| Period |

Returns |

| 1 year |

173.75% |

| 2 Years |

238.75% |

| 3 Years |

215.11% |

| 4 Years |

133.84% |

| 5 Years |

107.08% |

Chart

Also Read –Zen Technologies Share Price Watch: Board Nod to ₹1,000 Crore QIP Amid Q3 Success, Is It a Good Investment Opportunity?

Fundamental Analysis of Engineers India Ltd (EIL)

| Metric |

Value |

| Market Cap |

₹ 13,070 Cr. |

| Current Price |

₹ 233 |

| High / Low |

₹ 256 / 70.0 |

| Stock P/E |

27.6 |

| Book Value |

₹ 38.5 |

| Dividend Yield |

1.29% |

| ROCE |

23.7% |

| ROE |

18.4% |

| Face Value |

₹ 5.00 |

| Pledged percentage |

0.00% |

| EVEBITDA |

20.2 |

| Change in Prom Hold |

0.00% |

| Debt to equity |

0.01 |

| Return on equity |

18.4% |

| EPS |

₹ 8.41 |

| Price to book value |

6.04 |

| Dividend yield |

1.29% |

| Debt |

₹ 23.1 Cr. |

Peer Comparison

| No. |

Name |

Mar Cap Rs.Cr. |

P/E |

ROCE % |

| 1 |

Larsen & Toubro |

493,937.06 |

40.53 |

11.60 |

| 2 |

GMR Airports Inf |

46,506.96 |

N/A |

4.49 |

| 3 |

Rites |

16,454.67 |

34.19 |

29.71 |

| 4 |

HFCL |

15,109.27 |

49.46 |

15.17 |

| 5 |

Engineers India |

13,070.30 |

27.65 |

23.69 |

| 6 |

Techno Elec. Engg |

8,636.43 |

62.46 |

8.18 |

| 7 |

Reliance Infra. |

8,526.72 |

N/A |

8.95 |

Shareholding of Engineers India Ltd (EIL)

Last 5 Years’ Sales (In Cr.)

| March 2019 |

March 2020 |

March 2021 |

March 2022 |

March 2023 |

| 2,476 |

3,237 |

3,144 |

2,913 |

3,330 |

Last 5 Years’ Net Profit (In Cr.)

| March 2019 |

March 2020 |

March 2021 |

March 2022 |

March 2023 |

| 368 |

424 |

249 |

140 |

346 |

Balance Sheet of Engineers India Ltd (EIL)

Compounded Sales Growth

| 10 Years: |

3% |

| 5 Years: |

13% |

| 3 Years: |

1% |

| TTM: |

7% |

Compounded Profit Growth

| 10 Years: |

-6% |

| 5 Years: |

-2% |

| 3 Years: |

-7% |

| TTM: |

82% |

CAGR

| 10 Years: |

12% |

| 5 Years: |

15% |

| 3 Years: |

46% |

| 1 Year: |

180% |

Return on Equity

| 10 Years: |

14% |

| 5 Years: |

15% |

| 3 Years: |

14% |

| Last Year: |

18% |

Cash Flow (In Cr.)

| Metric |

Mar 2020 |

Mar 2021 |

Mar 2022 |

Mar 2023 |

| Cash from Operating Activity + |

376 |

171 |

48 |

-113 |

| Cash from Investing Activity + |

-229 |

776 |

61 |

322 |

| Cash from Financing Activity + |

-334 |

-904 |

-149 |

-176 |

| Net Cash Flow |

-188 |

43 |

-39 |

34 |

Revenue and Profit Trend

| Financial Year |

Revenue Growth |

Profit Growth |

| FY 2022-23 |

14.4% |

-0.66% |

| FY 2021-22 |

-7.55% |

32.72% |

| FY 2020-21 |

-3.07% |

-39.69% |

| FY 2019-20 |

31.04% |

16.26% |

| FY 2018-19 |

36.74% |

-2.06% |

Also Read –Is Bhansali Engineering Share Price Soar After 100% Dividend Declaration? Sets February 7 as the record date.

Conclusion

This is a comprehensive guide to Engineers India Ltd (EIL). The above-mentioned information and data are as of January 28, 2024. These figures and projections are based on our research, analysis, company fundamentals and history, experiences, and numerous technical analyses. In addition, we have discussed in depth the share’s prospects and growth potential. Hopefully, these details will be useful in your future investments. If you’re new to our website and want to stay up-to-date on the newest stock market news, join our Telegram group. If you have any further questions, please leave them in the comments section below. We will gladly address all of your inquiries. If you enjoyed this information, please share it with as many people as possible.

Disclaimer:

Dear Readers, we are not authorized by SEBI (Securities and Exchange Board of India). The information provided above is for educational purposes and should not be considered financial advice or stock recommendations. Share price predictions are for reference purposes and are based on positive market indicators. The analysis does not account for uncertainties about future or current market conditions. The author, brokerage firm, or Finreturns.com are not liable for losses resulting from decisions. Finreturns.com advises consulting with certified experts before investment decisions.

[…] Also Read –Engineers India Share Price Soars 88% in 3 Months, Mulls Dividend on Feb 2 […]

[…] Also Read –Engineers India Share Price Soars 88% in 3 Months, Mulls Dividend on Feb 2 […]