Persistent Systems, a leading midcap IT company, has declared its highest-ever dividend and plans for a stock split.

The board approved an interim dividend of 32 per share, which is the highest dividend the company has ever declared.

The record date for the dividend payment has not been finalized, but shareholders can expect further details once the record date is confirmed.

The company also received approval for a stock split, aiming to make the company’s shares more accessible to a broader range of investors.

Persistent Systems reported robust financial results for Q3, with net earnings of ₹286.1 crore, an 8.1% increase compared to the previous quarter.

The company’s earnings before interest and taxes (EBIT) reached ₹363 crore, marking a 9% growth over the September quarter.

The company’s recent announcements reflect its commitment to creating value for shareholders and its position in the IT sector.

About Persistent Systems Ltd.

- Persistent Systems Provides software engineering and strategy services for business modernization.

- The company owns pre-built platforms for quick integrations and partnerships with providers like Salesforce and AWS.

- The company has been the fastest-growing Indian IT services brand since 2020, with 268% growth. and offers cloud banking and insurance solutions, healthcare tools, and software development and innovation services.

- The company’s global presence is in 21+ countries, with the North and Central American region contributing 78%, India 10%, Europe 10%, and ROW 2% to total revenue.

- The segment that generates 70% of the company’s revenue is technology services, followed by partnership operations (26%), and the accelerite (products) segment (4%).

- The company’s top client base has increased, with the biggest client accounting for 9% of revenues in FY23.

- Best clientage includes 14 of the 30 most innovative US companies, 60 global Fortune 500 companies, 8 of the 10 largest banks in both the US and India, and 25+ global fintechs. 6 of 10 top medical device companies, Three of the top five CROs and analytical instrument manufacturers, four of the top ten US health systems and payers, and five of the top ten pharmaceutical companies.

- The company’s infrastructure: With a built-up area of 128,368 m2, it operates from leased facilities in Australia, Canada, Costa Rica, France, Germany, India, Malaysia, Mexico, Poland, Scotland, Sri Lanka, Switzerland, the UK, and the USA.

- The company’s key partners: works in partnerships with IT majors like AWS, IBM, Salesforce, Red Hat, Microsoft, Appian, Google, Snowflake, and Workato.

- The company’s client engagement: increased large clients above USD 5 million to 25 in FY22 from 17 in FY21.

- The company’s acquisitions include having acquired over 14 entities in countries like the US, UK, France, Switzerland, Germany, and India in the past 10 years.

- The company’s subsidiaries: As of FY23, the company has 29 direct and indirect subsidiaries.

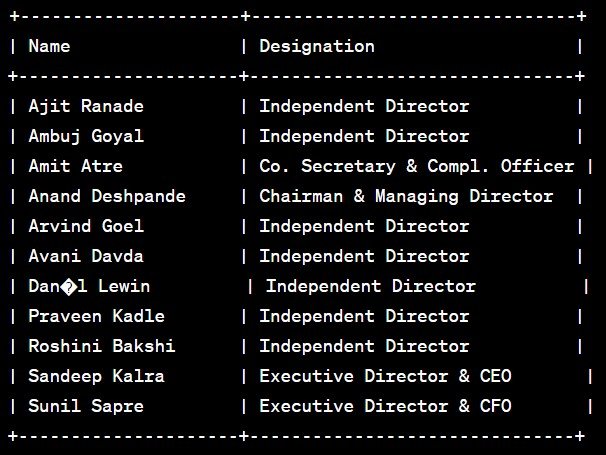

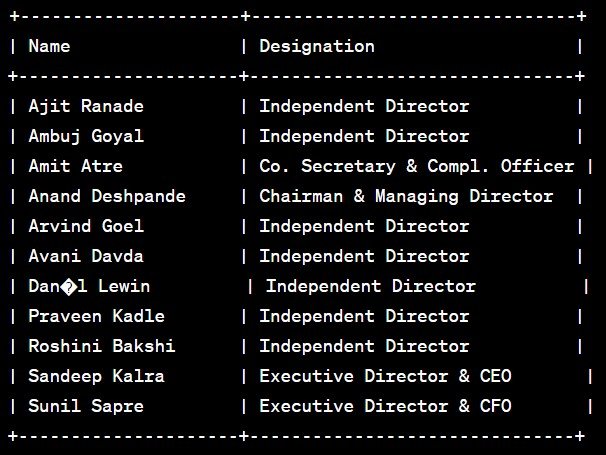

Management of Persistent Systems Ltd

Registered Address

Bhageerath,

No.402, Senapati Bapat Road,,

Pune

Maharashtra

411016

Tel: 020-67030000

Fax: 020-67030008

Email: info@persistent.com

Website: http://www.persistent.com

Industry Type

Sector – Information Technology

Sub Sector -Computers – Software & Consulting

Classification – Largecap

Industry Name – Computers – Software -Medium/ Small

BSE Scrip Code – 533179

NSE Scrip code – PERSISTENT

ISIN –INE262H01013

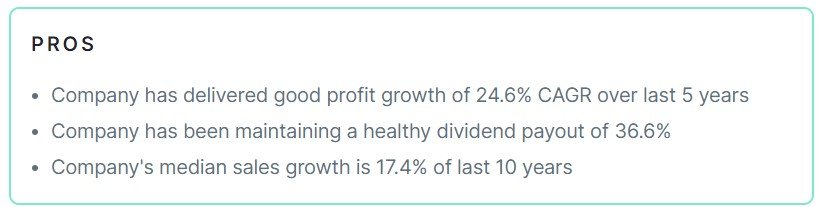

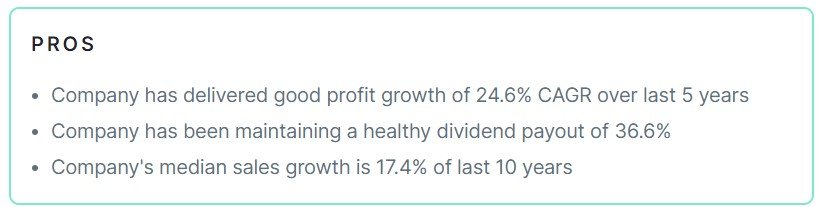

Pros & Cons of Persistent Systems Ltd

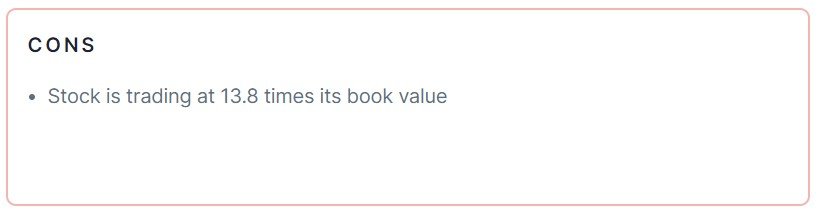

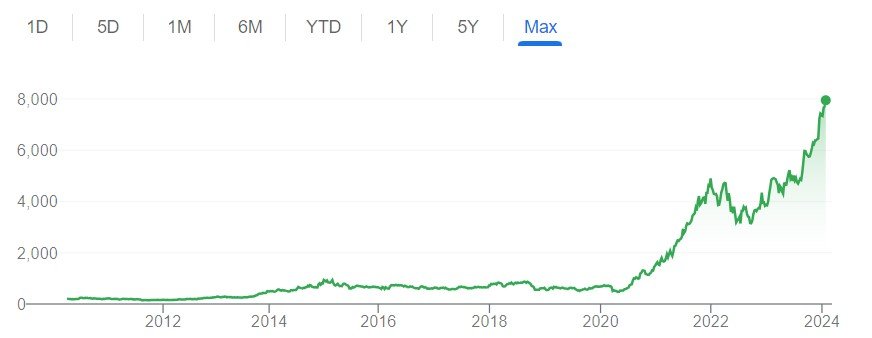

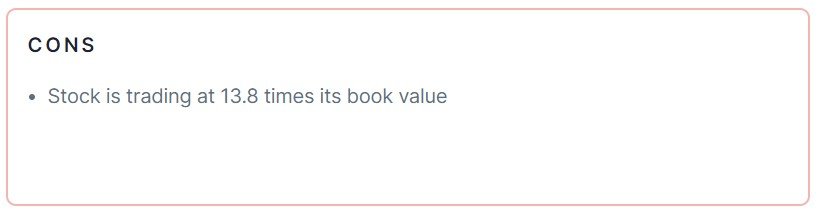

Historical Performance

| Years |

Low |

High |

| 1 Year |

3962.05 |

7965.00 |

| 3 Years |

1482.25 |

7965.00 |

| 5 Years |

420.05 |

7965.00 |

Investment Returns

| Period |

Returns |

| 1 year |

83.33% |

| 2 Years |

86.53% |

| 3 Years |

384.94% |

| 4 Years |

1028.02% |

| 5 Years |

1353.63% |

Technical Analysis of Persistent Systems Ltd

Chart

Moving Averages

| Period |

Value |

Signal |

| 5-EMA |

7792.70 |

Bullish |

| 10-EMA |

7668.79 |

Bullish |

| 20-EMA |

74.78.37 |

Bullish |

| 50-EMA |

7023.73 |

Bullish |

| 100-EMA |

6498.15 |

Bullish |

| 200-EMA |

5844.63 |

Bullish |

Technical Indicators

| Indicator |

Value |

Action |

| RSI (14) |

77.19 |

Neutral |

| ATR (14) |

193.43 |

Range |

| STOCH (9,6) |

94.60 |

Overbought |

| STOCHRSI (14) |

100.00 |

Overbought |

| MACD (12,26) |

252.22 |

Bullish |

| ADX (14) |

43.09 |

Trend |

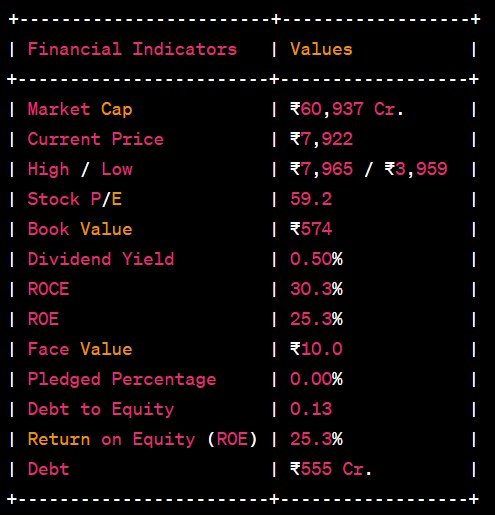

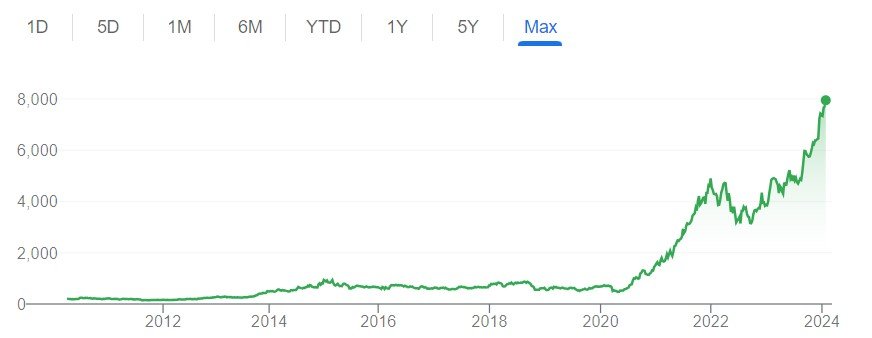

Fundamental Analysis of Persistent system Ltd

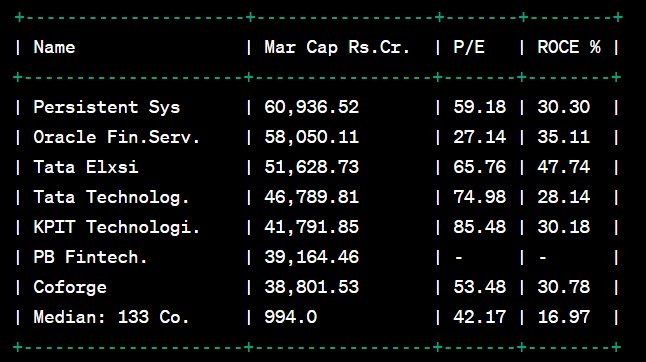

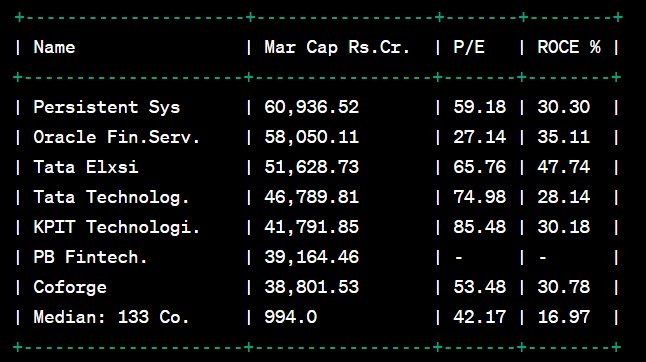

Peer Comparison

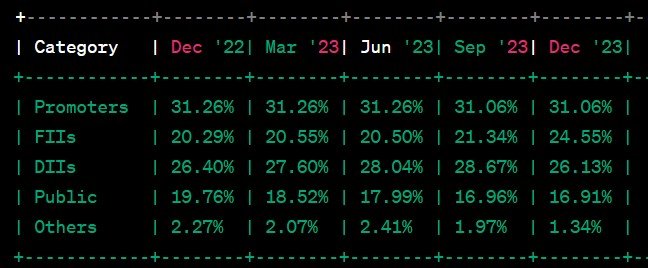

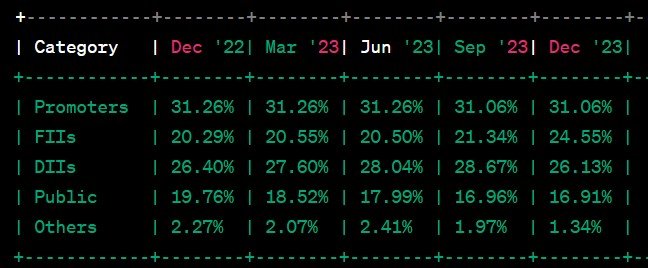

Shareholding Pattern of Persistent Systems Ltd

Last 5 Years’ Sales (In Cr.)

| March 2019 |

March 2020 |

March 2021 |

March 2022 |

March 2023 |

| 3,366 |

3,566 |

4,188 |

5,711 |

8,351 |

Last 5 Years’ Net Profit (In Cr.)

| March 2019 |

March 2020 |

March 2021 |

March 2022 |

March 2023 |

| 352 |

340 |

451 |

690 |

921 |

Last 5 Years’ Borrowings (In Cr.)

| March 2019 |

March 2020 |

March 2021 |

March 2022 |

March 2023 |

| 2 |

71 |

98 |

578 |

655 |

Compounded Sales Growth

| 10 Years: |

20% |

| 5 Years: |

22% |

| 3 Years: |

33% |

| TTM: |

23% |

Compounded Profit Growth

| 10 Years: |

17% |

| 5 Years: |

25% |

| 3 Years: |

41% |

| TTM: |

15% |

CAGR

| 10 Years: |

32% |

| 5 Years: |

71% |

| 3 Years: |

72% |

| 1 Year: |

83% |

Return on Equity

| 10 Years: |

19% |

| 5 Years: |

19% |

| 3 Years: |

22% |

| Last Year: |

25% |

Cash Flow (In Cr.)

| Particulars |

Mar 2019 |

Mar 2020 |

Mar 2021 |

Mar 2022 |

Mar 2023 |

| Operating Activities |

432 |

352 |

736 |

845 |

956 |

| Investing Activities |

-233 |

-6 |

-540 |

-971 |

-383 |

| Financing Activities |

-160 |

-329 |

-144 |

182 |

-404 |

| Net Cash Flow |

39 |

16 |

52 |

56 |

169 |

Revenue and Profit Trend

| Financial Year |

Revenue Growth |

Profit Growth |

| FY 2022-23 |

43.13% |

15.35% |

| FY 2021-22 |

44.2% |

35.79% |

| FY 2020-21 |

17.62% |

23.88% |

| FY 2019-20 |

7.62% |

29.43% |

| FY 2018-19 |

13.11% |

-7.92% |

Also Read –Bold Moves, Big Gains: IndiaMART’s 1:1 Split, 200% Dividend Shake Up Markets

Conclusion

This is a comprehensive guide to Persistent Systems Ltd. The above-mentioned data is as of January 22, 2024. These figures and projections are based on our research, analysis, company fundamentals and history, experiences, and numerous technical analyses. In addition, we have discussed in depth the share’s prospects and growth potential. Hopefully, these details will be useful in your future investments. If you’re new to our website and want to stay up-to-date on the newest stock market news, join our Telegram group. If you have any further questions, please leave them in the comments section below. We will gladly address all of your inquiries. If you enjoyed this information, please share it with as many people as possible.

Disclaimer: Dear Readers,

- We are not authorized by SEBI (Securities and Exchange Board of India).

- The information provided above is for educational purposes and should not be considered financial advice or stock recommendations.

- Share price predictions are for reference purposes and are based on positive market indicators.

- The analysis does not account for uncertainties about future or current market conditions.

- The author, brokerage firm, or Finreturns.com are not liable for losses resulting from decisions.

- Finreturns.com advises consulting with certified experts before investment decisions.

[…] Also Read –Game-Changer Alert: The Company Makes History with the Highest-Ever ₹32 Dividend Declaration! […]