- ITI Limited’s share price increased over 19% in just four months, reaching a record high of 375.65.

- ITI Limited’s is a government-owned company that outperformed market expectations, providing strong returns to shareholders in less than four months.

- The company’s 52-week high is 378.15, indicating good performance.

- Over the past year, shares soared by 257%, rising from 105.25 on January 17, 2023, to 375.65 on January 16, 2024.

- This growth is credited to strategic initiatives such as product innovation, market expansion, and efficient operational management.

- Big investors are advised to monitor market conditions, global economic uncertainties, and competition for informed decision-making.

About ITI Limited

- ITI Limited is involved in manufacturing, trading, and servicing telecommunication equipment.

- The company focuses on delivering telephone communication services.

Key Points:

- Turnkey Projects: Involved in BharatNet, ASCON, Net for Spectrum, e-governance projects, and FTTH rollout for Bharti Airtel.

- Service Offerings: Provides contract manufacturing, equipment testing services, component screening labs, assembly and testing for flight packages, and IT products and services.

- Manufacturing/Trading: Engaged in manufacturing and trading diverse products including energy meters, GPON ONT, PCM multiplexers, telephones, rugged telephones for defense forces, wifi equipment, IoT products, solar panels, radio modems, and microcomputers.

- Order Book: The FY23 order book stands at approximately 114.6 bn..

- Key Clientele: Preferred contractor for BSNL, Mahanagar Telephone Nigam Ltd., and Indian Defense Services.

- Revenue from Government: State governments (~76%), PSU companies (14%), other GOI agencies (4%), the Ministry of Defense (4%), and others (2%) as of FY20.

- Infrastructure Overview: Operates six manufacturing facilities across India and three R&D units.

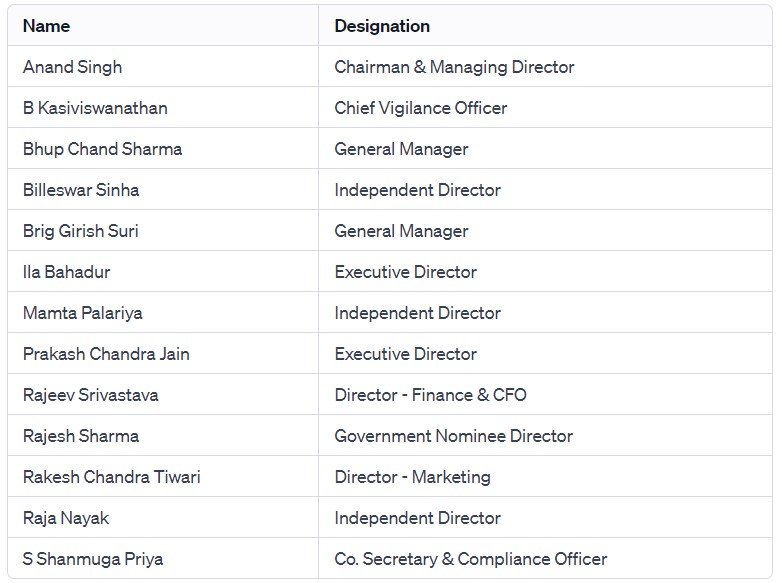

Management of ITI Limited

Registered Address of ITI Limited

ITI Bhavan,

Doorvani Nagar,,

Bengaluru

Karnataka

560016

Tel: 080-25614466

Fax: 080-25617525

Email: cosecy_crp@itiltd.co.in

Website: http://https://www.itiltd.in

Industry Type

Sector – Telecommunication

Sub Sector -Telecom – Equipment & Accessories

Classification – Largecap

Industry Name – Telecommunications – Equipment

BSE Scrip Code – 523610

NSE Scrip code – ITI

ISIN –INE248A01017

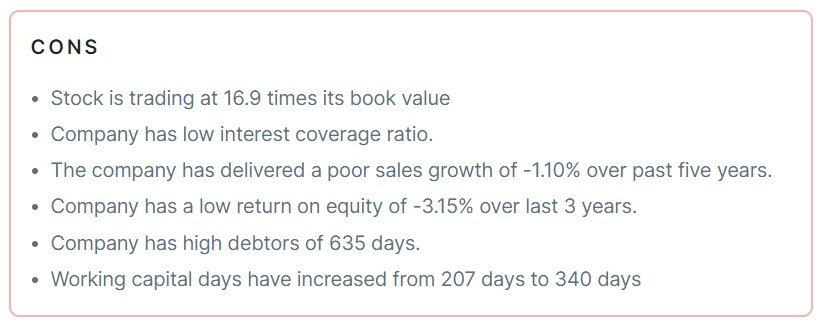

Pros & Cons of ITI Limited

Historical Performance

| Years | Low | High |

| 1 Year | 86.55 | 383.30 |

| 3 Years | 81.00 | 383.30 |

| 5 Years | 44.80 | 383.30 |

Investment Returns

| Period | Returns |

| 1 year | 253.80% |

| 2 Years | 210.30% |

| 3 Years | 194.58% |

| 4 Years | 261.71% |

| 5 Years | 257.20% |

Technical Analysis of ITI Limited

Chart

Moving Averages

| Period | Value | Signal |

| 5-EMA | 342.87 | Bullish |

| 10-EMA | 328.44 | Bullish |

| 20-EMA | 315.91 | Bullish |

| 50-EMA | 291.92 | Bullish |

| 100-EMA | 254.27 | Bullish |

| 200-EMA | 205.96 | Bullish |

Technical Indicators

| Indicator | Value | Action |

| RSI (14) | 77.12 | Neutral |

| ATR (14) | 17.77 | Range |

| STOCH (9,6) | 79.06 | Neutral |

| STOCHRSI (14) | 90.65 | Neutral |

| MACD (12,26) | 14.31 | Bullish |

| ADX (14) | 55.88 | Trend |

Fundamental Analysis of ITI Limited

Peer Comparison

Shareholding Pattern of ITI Limited

Last 5 Years’ Sales (In Cr.)

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| 1,668 | 2,059 | 2,362 | 1,861 | 1,395 |

Last 5 Years’ Net Profit (In Cr.)

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| 93 | 147 | 11 | 120 | -360 |

Last 5 Years’ Borrowings

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| 1,259 | 1,216 | 1,465 | 1,613 | 1,877 |

Compounded Sales Growth

| 10 Years: | 5% |

| 5 Years: | -1% |

| 3 Years: | -12% |

| TTM: | -13% |

Compounded Profit Growth

| 10 Years: | 0% |

| 5 Years: | % |

| 3 Years: | % |

| TTM: | -698% |

CAGR

| 10 Years: | 37% |

| 5 Years: | 29% |

| 3 Years: | 43% |

| 1 Year: | 249% |

Return on Equity

| 10 Years: | 0% |

| 5 Years: | 0% |

| 3 Years: | -3% |

| Last Year: | -15% |

Cash Flow (In Cr.)

| Particulars | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 |

| Operating Activities | 22 | -197 | 96 | -436 | -294 |

| Investing Activities | -124 | -75 | -306 | 177 | 46 |

| Financing Activities | -19 | 285 | 198 | 247 | 241 |

| Net Cash Flow | -121 | 13 | -12 | -12 | -6 |

Revenue and Profit Trend

| Financial Year | Revenue Growth | Profit Growth |

| FY 2022-23 | -25.01% | -399.89% |

| FY 2021-22 | -21.23% | 971.93% |

| FY 2020-21 | 14.73% | -92.4% |

| FY 2019-20 | 23.41% | 59.37% |

| FY 2018-19 | 13.1% | -59.86% |

Also Read –Record Rally: Multibagger Tops 52-Week High, Bags Rs 400 Cr Deals!

Conclusion

This is a comprehensive guide to ITI Limited. The above-mentioned data is as of January 17, 2024. These figures and projections are based on our research, analysis, company fundamentals and history, experiences, and numerous technical analyses. In addition, we have discussed in depth the share’s prospects and growth potential. Hopefully, these details will be useful in your future investments. If you’re new to our website and want to stay up-to-date on the newest stock market news, join our Telegram group and Whatsapp Channel. If you have any further questions, please leave them in the comments section below. We will gladly address all of your inquiries. If you enjoyed this information, please share it with as many people as possible.

Disclaimer: Dear Readers,

- We are not authorized by SEBI (Securities and Exchange Board of India).

- The information provided above is for educational purposes and should not be considered financial advice or stock recommendations.

- Share price predictions are for reference purposes and are based on positive market indicators.

- The analysis does not account for uncertainties about future or current market conditions.

- The author, brokerage firm, or Finreturns.com are not liable for losses resulting from decisions.

- Finreturns.com advises consulting with certified experts before investment decisions.

[…] Also Read –Investor Jackpot: Government Shares Double in Lightning-Fast 4-Month Ride […]