The recent update of Tejas Networks Ltd. stock

- Tejas Networks Ltd., a leading telecom and optical networking company. The company’s shares decreased by 10% on Tuesday.

- Tejas Networks company’s stock reached an intraday low of 736.70, decreasing the stock price by 15% over the past five trading days.

- The company’s Q3 FY24 financial results, which showed a loss of Rs 44.87 crore—a significant increase from the loss of Rs 15.15 crore the previous year—were what precipitated the downturn.

- Market experts remain optimistic about Tejas Networks’ future prospects, suggesting a potential share price recovery between ₹1100 and ₹1400.

- Global Financial, a brokerage firm, revised its price target for Tejas Networks from Rs. 1,050 to Rs. 1,025.

- Tejas Networks reported a substantial increase in revenue from operations during Q3, attributed to its diverse product offerings in data and optical networking.

- The company also noted an increase in inventory to ₹2,683 crore, leading to a rise in working capital of ₹671 crore.

- Tejas Networks is a Tata Group company, with promoters holding a significant stake of 55.80% in the company.

- Investors are advised to exercise caution, conduct thorough due diligence, and evaluate contrasting opinions before making investment decisions.

About Tejas Networks Ltd.

Tejas Networks Ltd. is a global telecom equipment company and optical networking company. Tejas Networks Ltd. specializes in designing, developing, and manufacturing high-performance optical and data networking products for various sectors.

The product portfolio of the company

- The company offers optical transmission, broadband access, and secured Ethernet/IP switches in the wireline category.

- It provides 4G Radio Access Network (RAN) for fixed and mobile broadband, 5G Open Radio Access Network (O-RAN), 5G Direct-to-Mobile (D2M) Broadcast, and Satellite Internet of Things (IoT) in the wireless category.

Revenue Breakdown of the Company

- Tejas Networks Ltd. shares revenue of 47% in the India-private sector, 36% in the international segment, and 17% in the India-government segment.

The diverse customer base of the company

- The company builds a diverse customer base, including telecom operators, Internet service providers, critical infrastructure entities, web-scale companies, and government agencies.

Research and development are the focus of the company.

- The company’s continuous investment in R&D will help it stay competitive globally.

- The company holds an impressive intellectual property portfolio with approximately 350 patents and over 300 silicon IPs.

Asset-Light Manufacturing Model

- The company adopts an asset-light manufacturing model, focusing on final integration, testing, and quality control.

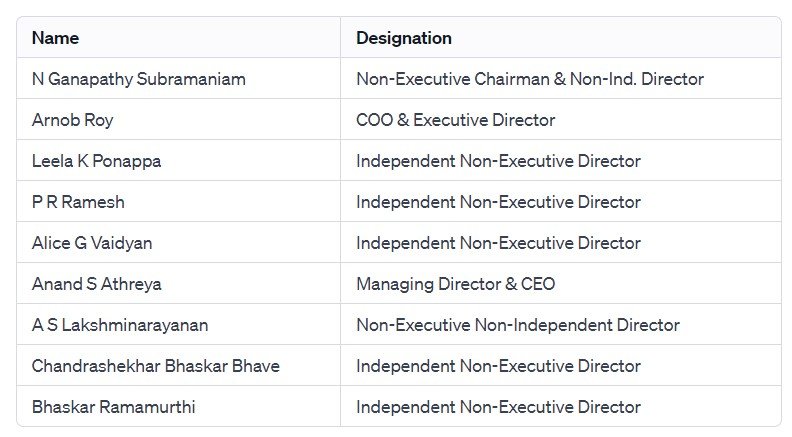

Management of Tejas Networks Ltd

Registered Address

Plot No. 25, JP Software Park,

Electronic City Phase-1,,Hosur Road,

Bengaluru

Karnataka

560100

Tel: 080-41794600

Fax: 080-28520201

Email: corporate@tejasnetworks.com

Website: http://www.tejasnetworks.com

Industry Type

Sector – Telecommunication

Sub Sector – Telecom – Equipment & Accessories

Classification – Small cap

Industry Name – Telecommunications & Equipment

BSE Scrip Code – 540595

NSE Scrip code – TEJASNET

ISIN –INE010J1012

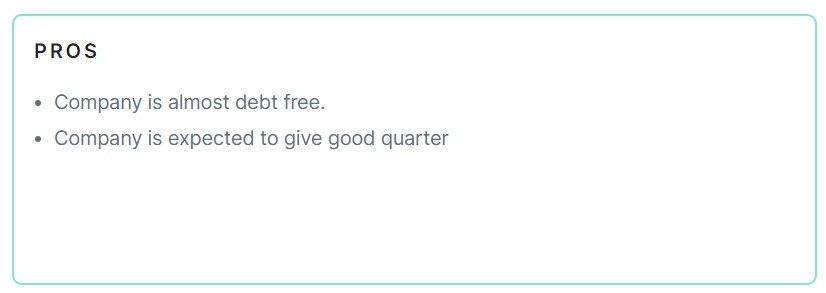

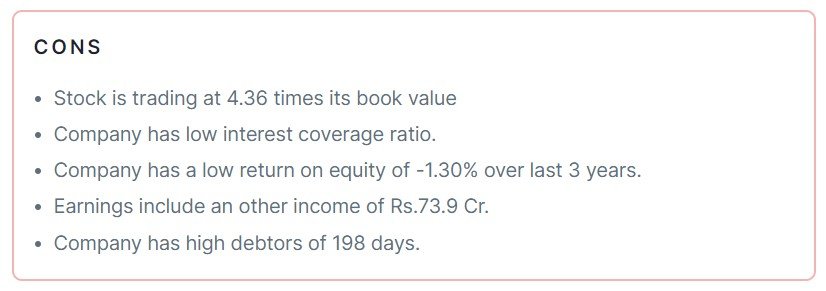

Pros & Cons of Tejas Networks Ltd

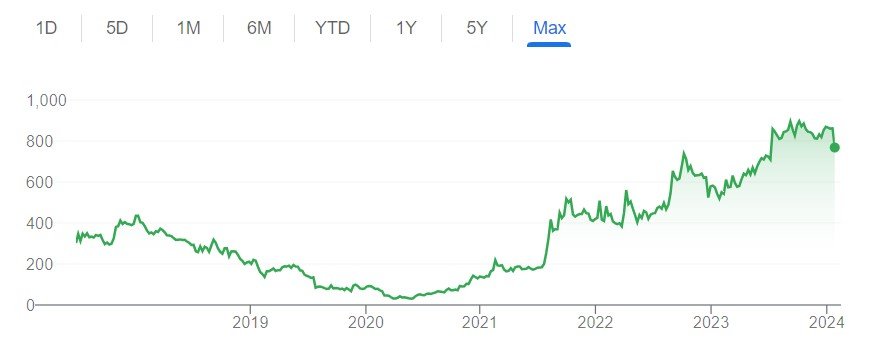

Historical Performance

| Years | Low | High |

| 1 Year | 510.00 | 940.00 |

| 3 Years | 135.00 | 940.00 |

| 5 Years | 28.90 | 940.00 |

Investment Returns

| Period | Returns |

| 1 year | 43.93% |

| 2 Years | 86.96% |

| 3 Years | 464.36% |

| 4 Years | 817.55% |

| 5 Years | 312.63% |

Technical Analysis of Tejas Networks Ltd

Chart

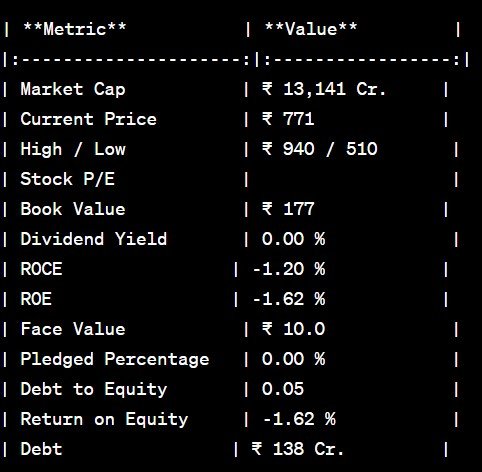

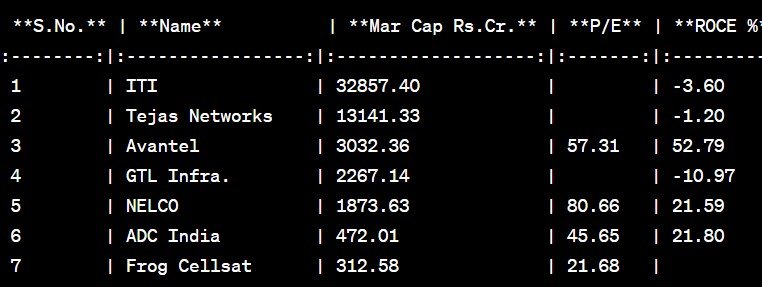

Fundamental Analysis of Tejas Networks Ltd

Peer Comparison

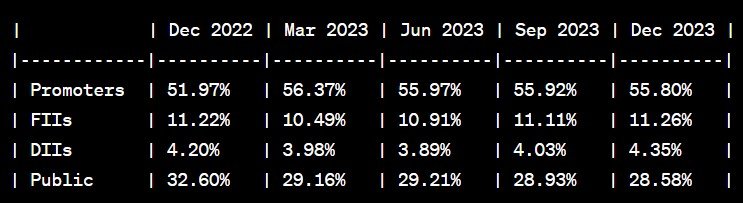

Shareholding of Tejas Networks Ltd

Last 5 Years’ Sales (In Cr.)

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| 900 | 391 | 527 | 551 | 920 |

Last 5 Years’ Net Profit (In Cr.)

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| 147 | -237 | 38 | -63 | -36 |

Last 5 Years’ Borrowings (In Cr.)

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| 1 | 28 | 22 | 20 | 50 |

Compounded Sales Growth

| 10 Years: | 10% |

| 5 Years: | 4% |

| 3 Years: | 33% |

| TTM: | 93% |

Compounded Profit Growth

| 10 Years: | -4% |

| 5 Years: | % |

| 3 Years: | 23% |

| TTM: | -28% |

CAGR

| 10 Years: | % |

| 5 Years: | 33% |

| 3 Years: | 78% |

| 1 Year: | 44% |

Return on Equity

| 10 Years: | 1% |

| 5 Years: | -2% |

| 3 Years: | -1% |

| Last Year: | -2% |

Cash Flow (In Cr.)

| Particulars | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 |

| Operating Activities | -82 | 1 | 158 | -17 | -380 |

| Investing Activities | -104 | 71 | -167 | -828 | -581 |

| Financing Activities | -11 | -22 | -3 | 839 | 999 |

| Net Cash Flow | -197 | 50 | -13 | -6 | 38 |

Revenue and Profit Trend

| Financial Year | Revenue Growth | Profit Growth |

| FY 2022-23 | 58.26% | -104.77% |

| FY 2021-22 | 4.7% | -270.9% |

| FY 2020-21 | 35.81% | -115.79% |

| FY 2019-20 | -56.8% | -260.99% |

| FY 2018-19 | 20.26% | 36.94% |

Also Read –Penny Stock Powerhouse: Unlocking the Potential of ₹10 Share with FII Backing

Conclusion

This is a comprehensive guide to Tejas Networks Ltd. The above-mentioned information and figures are as of January 25, 2024. These figures and projections are based on our research, analysis, company fundamentals and history, experiences, and numerous technical analyses. In addition, we have discussed in depth the share’s prospects and growth potential. Hopefully, these details will be useful in your future investments. If you’re new to our website and want to stay up-to-date on the newest stock market news, join our Telegram group. If you have any further questions, please leave them in the comments section below. We will gladly address all of your inquiries. If you enjoyed this information, please share it with as many people as possible.

Disclaimer: Dear Readers,

- We are not authorized by SEBI (Securities and Exchange Board of India).

- The information provided above is for educational purposes and should not be considered financial advice or stock recommendations.

- Share price predictions are for reference purposes and are based on positive market indicators.

- The analysis does not account for uncertainties about future or current market conditions.

- The author, brokerage firm, or Finreturns.com are not liable for losses resulting from decisions.

- Finreturns.com advises consulting with certified experts before investment decisions.

[…] Also Read –Next Level Gains: Tata Group Shares Ready to Double-A Compelling Investment Opportunity. Should You … […]