- Man Industries Ltd. has announced significant growth with new orders of approximately Rs 400 crore.

- The company plans to supply a wide range of pipes to both domestic and international clients within the next six months.

- The company’s order book stood at Rs 1,300 crore, indicating the company’s commitment to timely and efficient project execution.

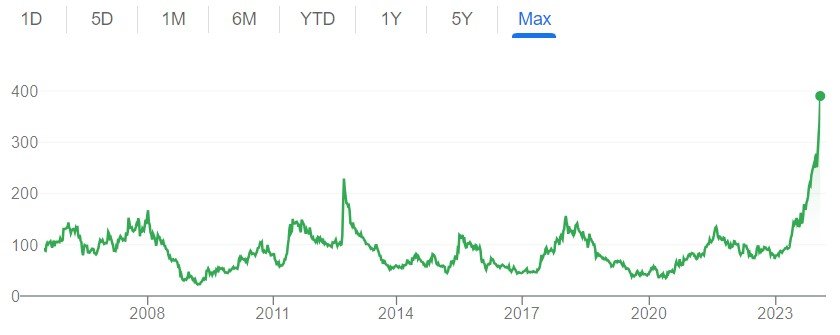

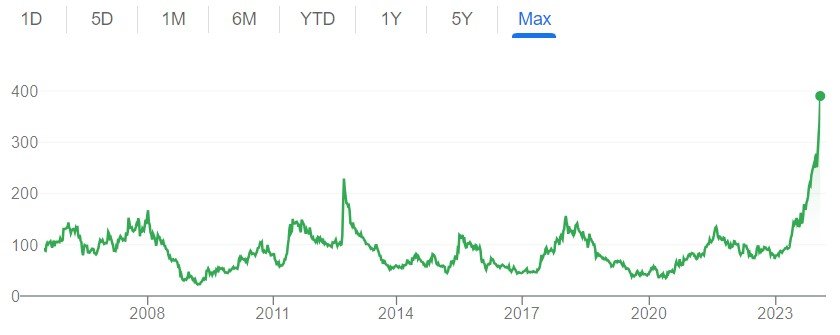

- The company’s stock has experienced a significant 5.12% surge, reaching an intraday and 52-week high of Rs 397.05 per share.

- The company’s Q2 FY24 saw a remarkable 119% increase in net sales, reaching Rs 1,018 crore.

- In the annual results, net sales grew by 4% to Rs 2,231 crore, with a slight dip of 33% to Rs 68 crore in FY23 compared to FY22.

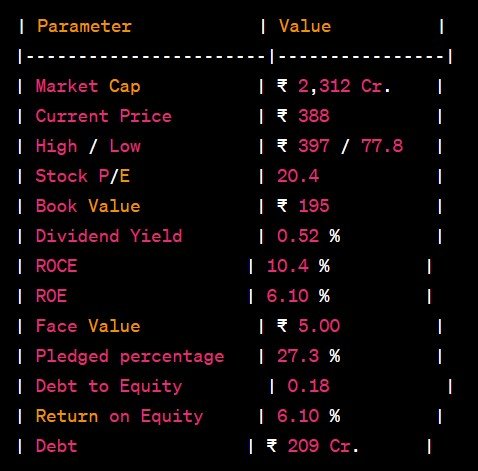

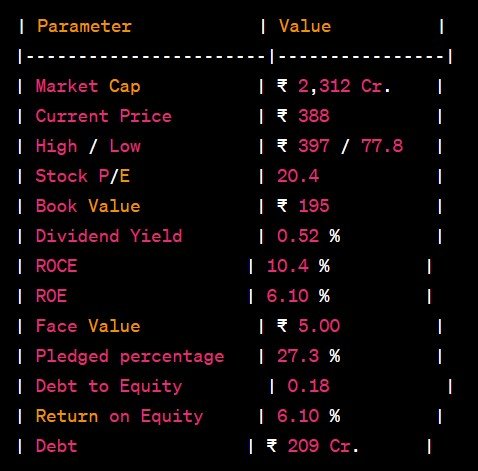

- Man Industries has a market capitalization of Rs 2,344 crore with a 3-year CAGR of 60%.

- The stock has delivered multi-bagger returns, surging by an impressive 375% in just one year, outpacing the BSE Small-Cap Index.

About Man Industries Ltd

- Man Industries Ltd is a Leading Pipe manufacturer in India

- The company was established in 1988, supplying over 17,000 km of pipes.

- The company’s revenue mix in FY23: 50% HSAW, 40% LSAW, and 10% coating accounting.

- The company operates from Anjar, Gujarat, and Pithampur, Madhya Pradesh.

- The company plans to diversify into Seamless Stainless Steel Pipes and Steel Bends and Connectors.

- The company has a diverse clientele that includes GAIL, IOCL, Reliance Industries, BHEL, ONGC, Adani, and Larsen & Toubro.

- The company established two subsidiaries in 2022: Man Offshore and Drilling Limited and Man Stainless Steel Tubes Limited.

- The company’s growth strategy includes optimizing facilities, exploring new sectors, and producing new products.

Management of Man Industries Ltd

Registered Address

MAN House,

101, S. V. Road,,Opp. Pawan Hans,

Mumbai

Maharashtra

400056

Tel: 022-66477500

Fax: 022-66477600

Email: cs@maninds.org

Website: http://www.mangroup.com

Industry Type

Sector – Capital Goods

Sub Sector -Iron & Steel products

Classification – Smallcap

Industry Name – Steel- Medium/Small

BSE Scrip Code – 513269

NSE Scrip code – MANINDS

ISIN –INE993A01026

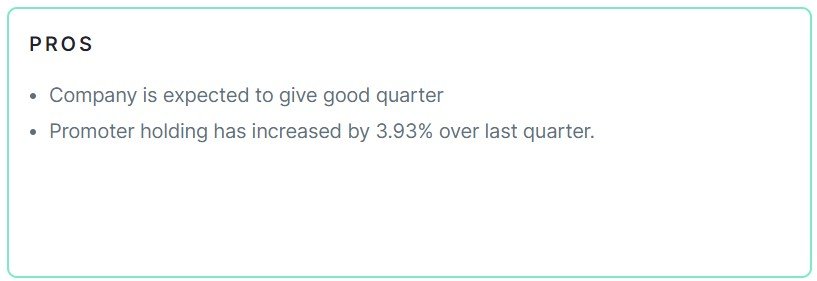

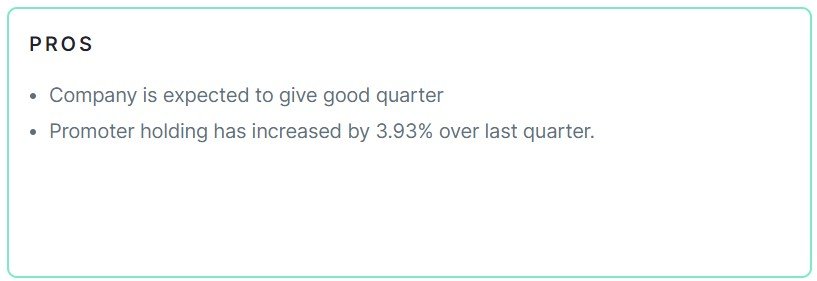

Pros & Cons of Man Industries Ltd

Historical Performance

| Years |

Low |

High |

| 1 Year |

78.05 |

396.85 |

| 3 Years |

69.50 |

397.05 |

| 5 Years |

26.20 |

397.05 |

Investment Returns

| Period |

Returns |

| 1 year |

372% |

| 2 Years |

262.23% |

| 3 Years |

369.96% |

| 4 Years |

711.95% |

| 5 Years |

537.45% |

Technical Analysis of Man Industries Ltd

Chart

Moving Averages

| Period |

Value |

Signal |

| 5-EMA |

349.48 |

Bullish |

| 10-EMA |

330.23 |

Bullish |

| 20-EMA |

308.20 |

Bullish |

| 50-EMA |

275.55 |

Bullish |

| 100-EMA |

240.62 |

Bullish |

| 200-EMA |

197.54 |

Bullish |

Technical Indicators

| Indicator |

Value |

Action |

| RSI (14) |

82.32 |

Overbought |

| ATR (14) |

18.13 |

Range |

| STOCH (9,6) |

90.40 |

Overbought |

| STOCHRSI (14) |

100.00 |

Overbought |

| MACD (12,26) |

24.84 |

Bullish |

| ADX (14) |

37.94 |

Trend |

Fundamental Analysis of Man Industries Ltd

Peer Comparison

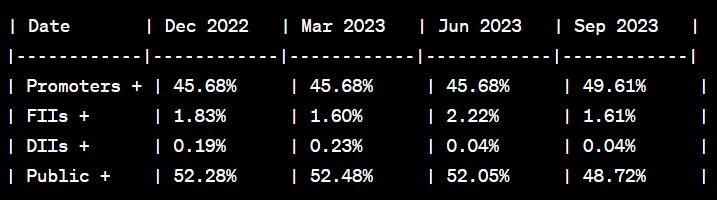

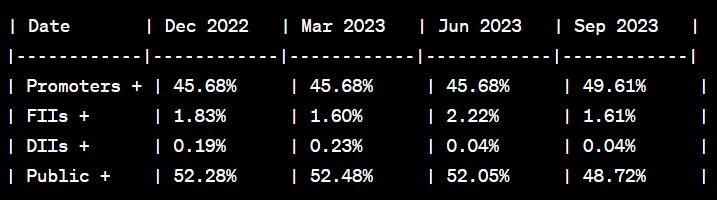

Shareholding of Man Industries Ltd

Last 5 Years’ Sales (In Cr.)

| March 2019 |

March 2020 |

March 2021 |

March 2022 |

March 2023 |

| 2,222 |

1,759 |

2,080 |

2,139 |

2,231 |

Last 5 Years’ Net Profit (In Cr.)

| March 2019 |

March 2020 |

March 2021 |

March 2022 |

March 2023 |

| 59 |

56 |

101 |

102 |

68 |

Last 5 Years’ Borrowings

| March 2019 |

March 2020 |

March 2021 |

March 2022 |

March 2023 |

| 244 |

294 |

296 |

57 |

299 |

Compounded Sales Growth

| 10 Years: |

4% |

| 5 Years: |

7% |

| 3 Years: |

8% |

| TTM: |

25% |

Compounded Profit Growth

| 10 Years: |

-4% |

| 5 Years: |

-2% |

| 3 Years: |

1% |

| TTM: |

81% |

CAGR

| 10 Years: |

24% |

| 5 Years: |

47% |

| 3 Years: |

67% |

| 1 Year: |

372% |

Return on Equity

| 10 Years: |

9% |

| 5 Years: |

9% |

| 3 Years: |

10% |

| Last Year: |

6% |

Cash Flow (In Cr.)

| Particulars |

Mar 2019 |

Mar 2020 |

Mar 2021 |

Mar 2022 |

Mar 2023 |

| Operating Activities |

137 |

214 |

-60 |

451 |

-119 |

| Investing Activities |

0 |

-46 |

4 |

-119 |

-135 |

| Financing Activities |

-138 |

-37 |

-63 |

-267 |

209 |

| Net Cash Flow |

-1 |

131 |

-119 |

65 |

-45 |

Revenue and Profit Trend

| Financial Year |

Revenue Growth |

Profit Growth |

| FY 2022-23 |

-0.08% |

-33.55% |

| FY 2021-22 |

0.91% |

0.6% |

| FY 2020-21 |

17.97% |

86.41% |

| FY 2019-20 |

-20.6% |

-5.93% |

| FY 2018-19 |

40.89% |

-8.71% |

Also Read – Unstoppable Growth: Navratna PSU Stock’s Shares Jump 119% with Back-to-Back Orders

Conclusion

This is a comprehensive guide to Man Industries Ltd. The above-mentioned data is as of January 17, 2024. These figures and projections are based on our research, analysis, company fundamentals and history, experiences, and numerous technical analyses. In addition, we have discussed in depth the share’s prospects and growth potential. Hopefully, these details will be useful in your future investments. If you’re new to our website and want to stay up-to-date on the newest stock market news, join our Telegram group and Whatsapp Channel. If you have any further questions, please leave them in the comments section below. We will gladly address all of your inquiries. If you enjoyed this information, please share it with as many people as possible.

Disclaimer: Dear Readers,

- We are not authorized by SEBI (Securities and Exchange Board of India).

- The information provided above is for educational purposes and should not be considered financial advice or stock recommendations.

- Share price predictions are for reference purposes and are based on positive market indicators.

- The analysis does not account for uncertainties about future or current market conditions.

- The author, brokerage firm, or Finreturns.com are not liable for losses resulting from decisions.

- Finreturns.com advises consulting with certified experts before investment decisions.

[…] Also Read –Record Rally: Multibagger Tops 52-Week High, Bags Rs 400 Cr Deals! […]