Tata Communications is a leading player in India’s telecommunications industry. The company’s revenue increased 24.4% in the December quarter. The company’s revenue reached Rs 5,633 crore in the present quarter. However, the profit of the company (Rs 44.81 crore) decreased by 88.6% from the last quarter. In the last quarter, the profit was Rs 393.88 crore. As a result, the company’s share price increased by 4.3% today.

The top brokerage set a target price of Rs 2300 for the shares. Tata Communications has focused on revenue growth, utilizing acquisitions as a key driver, aiming to gain a larger share in cloud services, networking, media, and entertainment. The CEO, AS Lakshminarayanan, expressed satisfaction with the company’s solid growth and plans to leverage its data revenues, which have crossed Rs 4,000 crore, with digital services contributing a substantial 45%.

About Tata Communications Limited

- Tata Communications Limited Incorporated on March 19, 1986, as Videsh Sanchar Nigam Limited (VSNL).

- The Tata Group played a pivotal role in VSNL after the Indian government sold 25% of its ownership in 2002.

- Tata Group Acquired 50% Shares in 2002 and as of FY23, Tata Sons holds a 58.86% stake in TCL.

- In FY21, the Government of India divested its entire shareholding of 26.12%, with 16.12% sold to the public and the remaining 10% to PFL, a wholly-owned subsidiary of Tata Sons Private Limited (TSPL).

Business Operations and Infrastructure

- TCL is a global leader in enabling digital ecosystems.

- It offers managed solutions to multinational companies and service providers.

- TCL partners with 300 of the Fortune 500 companies.

Business Segments and FY23 Financials

- TCL’s businesses are primarily divided into Data Business, Voice, and Other segments.

- TCL is the world’s largest wholesale voice provider.

NCDs, Litigation, and Recent Developments

- TCL approved the allotment of ₹1,750 crores worth of Non-Convertible Debentures (NCDs) in August 2023.

- The company has a Tax Deducted at Source (TDS) litigation pending with the Commissioner of Income Tax (Appeals), Mumbai.

Strategic Collaborations and Focus Areas

- TCL and Singapore Airlines have entered into a multi-year agreement to transform the airline’s communications and collaboration tools.

- TCL aims to increase the share of the Data Platform Services (DPS) sub-segment in the Data Business segment to 50% by FY27.

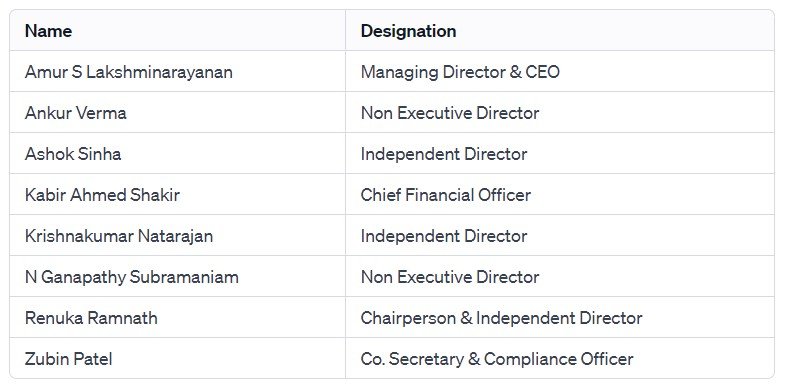

Management of Tata Communications Limited

Registered Address

VSB, Mahatma Gandhi Road,

Fort,

Mumbai

Maharashtra

400001

Tel: 022-66591968

Fax: 022-

Email: investor.relations@tatacommunications.com

Website: http://www.tatacommunications.com

Industry Type

Sector – Telecommunication

Sub Sector -Telecom- Cellular & Fixed line services

Classification – Largecap

Industry Name – Telecommunications – Service provider

BSE Scrip Code – 500483

NSE Scrip code – TATACOMM

ISIN –INE151A01013

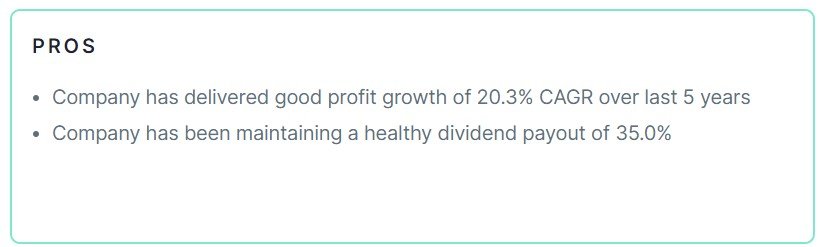

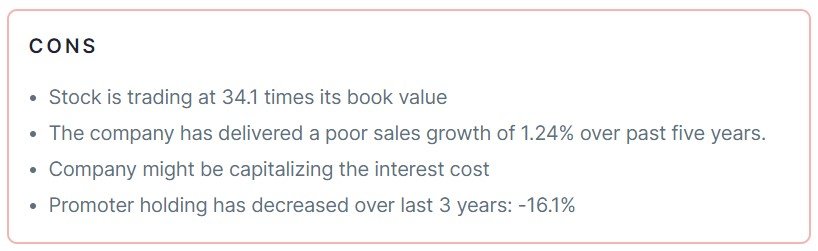

Pros & Cons of Tata Communications Limited

Historical Performance

| Years | Low | High |

| 1 Year | 1156.80 | 1957.35 |

| 3 Years | 856.25 | 1957.35 |

| 5 Years | 200.00 | 1957.35 |

Investment Returns

| Period | Returns |

| 1 year | 26.74% |

| 2 Years | 14.06 |

| 3 Years | 53.91% |

| 4 Years | 296.20% |

| 5 Years | 238.71% |

Technical Analysis of Tata Communications Limited

Chart

Moving Averages

| Period | Value | Signal |

| 5-EMA | 1740.99 | Bullish |

| 10-EMA | 1739.32 | Bullish |

| 20-EMA | 1739.16 | Bullish |

| 50-EMA | 1735.83 | Bullish |

| 100-EMA | 1714.33 | Bullish |

| 200-EMA | 1625.49 | Bullish |

Technical Indicators

| Indicator | Value | Action |

| RSI (14) | 55.57 | Neutral |

| ATR (14) | 49.74 | Range |

| STOCH (9,6) | 75.83 | Neutral |

| STOCHRSI (14) | 33.33 | Overbought |

| MACD (12,26) | 1.35 | Bearish |

| ADX (14) | 14.04 | No Trend |

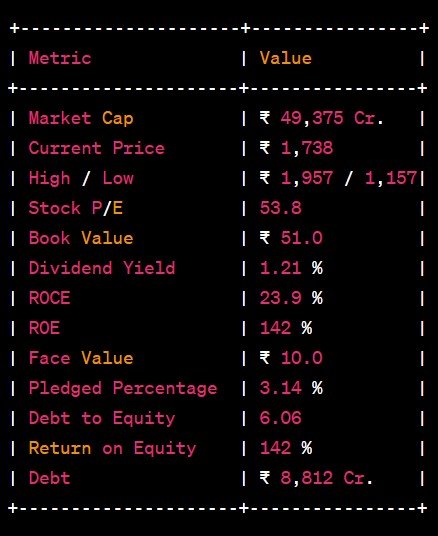

Fundamental Analysis of Tata Communications Limited

Peer Comparison

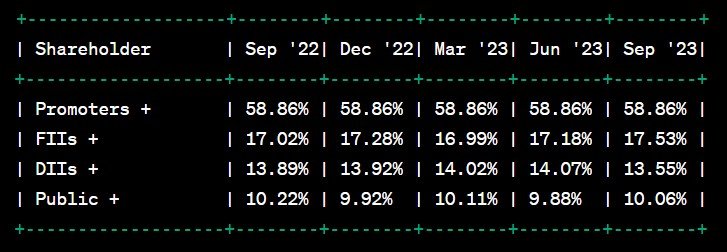

Shareholding of Tata Communications Limited

Last 5 Years’ Sales (In Cr.)

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| 16,525 | 17,068 | 17,100 | 16,725 | 17,838 |

Last 5 Years’ Net Profit (In Cr.)

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| -80 | -85 | 1,252 | 1,485 | 1,801 |

Last 5 Years’ Borrowings

| March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

| 9,935 | 12,413 | 11,394 | 9,122 | 8,577 |

Compounded Sales Growth

| 10 Years: | 0% |

| 5 Years: | 1% |

| 3 Years: | 1% |

| TTM: | 13% |

Compounded Profit Growth

| 10 Years: | 16% |

| 5 Years: | 20% |

| 3 Years: | 72% |

| TTM: | -49% |

CAGR

| 10 Years: | 25% |

| 5 Years: | 40% |

| 3 Years: | 15% |

| 1 Year: | 27% |

Return on Equity

| 10 Years: | % |

| 5 Years: | % |

| 3 Years: | % |

| Last Year: | 142% |

Cash Flow (In Cr.)

| Particulars | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 |

| Operating Activities | 1,844 | 2,525 | 3,180 | 4,204 | 4,384 |

| Investing Activities | -2,284 | -1,521 | -2,007 | -894 | -1,836 |

| Financing Activities | -28 | -942 | -1,205 | -3,431 | -2,241 |

| Net Cash Flow | -467 | 61 | -32 | -121 | 308 |

Revenue and Profit Trend

| Financial Year | Revenue Growth | Profit Growth |

| FY 2022-23 | 9.85% | -42.93% |

| FY 2021-22 | 5.82% | 21.26% |

| FY 2020-21 | 8.26% | 361.09% |

| FY 2019-20 | 6.7% | -147.2% |

| FY 2018-19 | 2.61% | 265.89% |

Also Read –Investor Jackpot: Government Shares Double in Lightning-Fast 4-Month Ride

Conclusion

This is a comprehensive guide to Tata Communications Limited. The above-mentioned data is as of January 19, 2024. These figures and projections are based on our research, analysis, company fundamentals and history, experiences, and numerous technical analyses. In addition, we have discussed in depth the share’s prospects and growth potential. Hopefully, these details will be useful in your future investments. If you’re new to our website and want to stay up-to-date on the newest stock market news, join our Telegram group. If you have any further questions, please leave them in the comments section below. We will gladly address all of your inquiries. If you enjoyed this information, please share it with as many people as possible.

Disclaimer: Dear Readers,

- We are not authorized by SEBI (Securities and Exchange Board of India).

- The information provided above is for educational purposes and should not be considered financial advice or stock recommendations.

- Share price predictions are for reference purposes and are based on positive market indicators.

- The analysis does not account for uncertainties about future or current market conditions.

- The author, brokerage firm, or Finreturns.com are not liable for losses resulting from decisions.

- Finreturns.com advises consulting with certified experts before investment decisions.

[…] Also Read –TATA Group Shares Surge with ₹5,633 Crore Revenue, Setting a 9-Year Record […]